Three leading big-city mayoral candidates are mainstreaming fringe tax policies aimed at redistributing money among citizens based on personal wealth, race or whether they own a vacant building.

The candidates in New York City, Minneapolis and Seattle are challenging Democratic orthodoxy while portraying themselves as the progressive antidote to President Donald Trump’s Make America Great Again policies.

At least two of those candidates are openly marketing themselves as democratic socialists, with Election Day on Nov. 4.

Regardless of their personal labels or ideologies, each candidate has proposed reforms to the tax system that mark a radical departure.

It has long been a refrain in Democratic circles that the rich need to pay their fair share of taxes. Most Americans would agree; 58% of those surveyed, including a plurality of Republicans, believe the country should raise taxes on those making over $400,000, according to one of the latest polls.

However, these candidates promise to take the credo a step further, proposing new taxes that would penalize a landlord for choosing not to rent out or use a property or increase tax burdens on neighborhoods based on their historical racial makeup and financial success to right historical injustice.

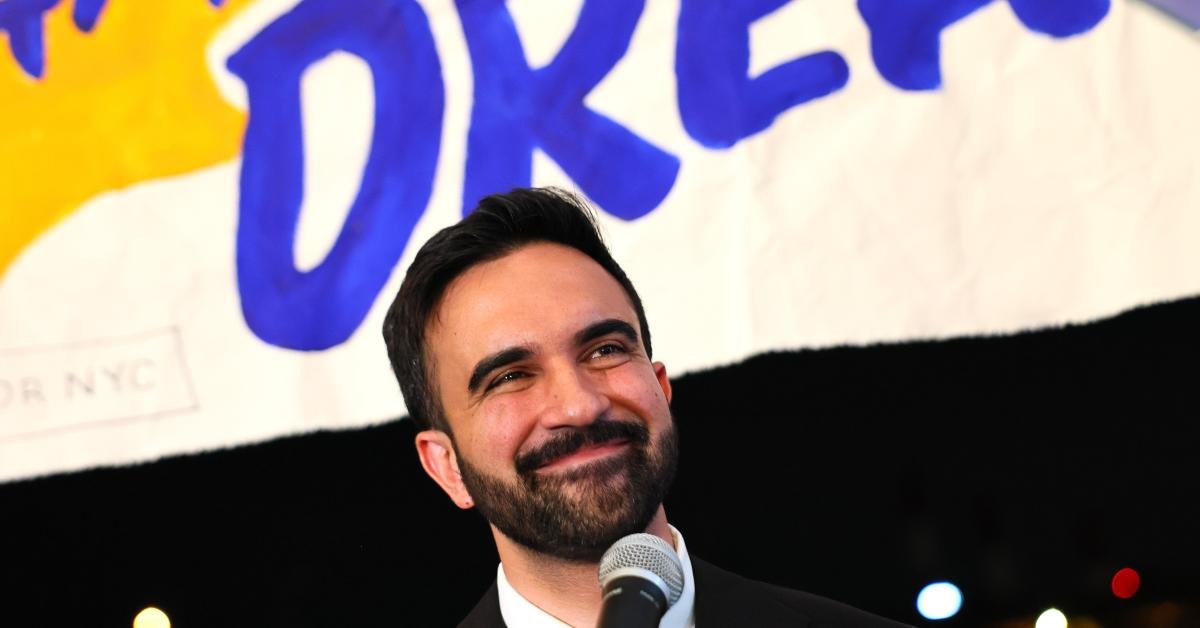

New York’s Zohran Mamdani

Zohran Mamdani, the self-proclaimed Democratic Socialist candidate for New York mayor, has already upset the apple cart of the New York City Democratic Party establishment – having defeated former Gov. Andrew Cuomo in the Democratic primary while using his surge in the polls to effectively help close any path to reelection Democrat Mayor Eric Adams had before he exited the race in September.

Mamdani, with less than two weeks before Election Day, now has a double-digit lead over Republican Curtis Sliwa and Cuomo, now running as an independent. He has served in the New York State Assembly since 2021 and is a member of the Democratic Socialists of America. He also has endorsements from prominent progressive politicians, including Vermont Independent Sen. Bernie Sanders and New York Democratic Rep. Alexandria Ocasio-Cortez.

Mamdani’s policy proposals and background have garnered significant national attention. From rent controls, to state-owned grocery stores, to fare-free public transportation, the candidate’s populist messaging and redistributive economic policy have vaulted him to the front of the race.

Mamdani’s tax plans are ambitious. He is calling for higher taxes on the rich and raising the corporate tax rate in the city to help fund proposals for universal childcare, free transit, a whopping $30 minimum wage, rent freezes, and building more affordable housing.

But Mamdani also pitched raising taxes on specifically “whiter” and “richer” neighborhoods, a startling proposal. He claims that such a tax would fix the city’s “unbalanced” property tax system.

“The mayor can fix this by pushing class assessment percentages down for everyone and adjusting rates up, effectively lowering tax payments for homeowners in neighborhoods like Jamaica and Brownsville while raising the amount paid in the most expensive Brooklyn brownstones,” reads Mamdani’s campaign policy on housing.

As an example, in Jamaica (Queens) and Brownsville (Brooklyn), more than 70% of residents are Black or Hispanic. In Park Slope, one Brooklyn neighborhood with the kind of “historic brownstones” Mamdani described, 60% of the residents are White.

The proposal earned Mamdani a sharp rebuke from opponents. “In America, we don’t tax people for their race,” Sliwa said. “Zohran Mamdani’s plan to tax people based on skin color isn’t just wrong, it’s racism, pure and simple.”

Mamdani stood by his use of “whiter” to describe the neighborhoods he wanted to target. He called it “a description of what we see right now” but claimed it was not “driven by race.”

“It’s more of an assessment of what neighborhoods are being undertaxed versus overtaxed,” Mamdani said on NBC-TV’s “Meet the Press.” “We’ve seen time and again that this is a property tax system that is inequitable. The focus here is to actually ensure a fair property tax system. And the use of that language is just an assessment of that neighborhood.”

Seattle’s Katie Wilson

On America’s West Coast, thousands of miles away from New York City, an upstart mayoral candidate is challenging incumbent Democrat Bruce Harrell, and she has not shied away from comparisons to her Empire State comrade.

Katie Wilson is a community organizer who is widely considered to be far more progressive than Harrell and has focused on many issues in common with Mamdani. Both Wilson and Mamdani are running on platforms that include affordable public transit, raising taxes on the rich, stronger renter protections, and universal child care.

In an effort to boost the availability of rental properties, both commercial and residential, Wilson wants to tax landlords for vacant properties, bringing Seattle in line with only a handful of the United States’ most progressive cities that charge such a tax.

“A vacancy tax will incentivize property owners to rent their property for residential or commercial use, instead of holding it empty as a speculative investment,” Wilson’s campaign website reads.

Unlike Mamdani, Wilson is not a member of the Democratic Socialists of America, but she has said that she is fine with being called a Democrat, a socialist, or both, according to an interview she gave to The Center Square.

She told the news outlet that she and Mamdani share a similar vision for their cities and noted that she was inspired by Mamdani’s candidacy in New York.

“In the wake of the election, I think there’s a feeling that that style of Democratic Party politics failed to stop the train wreck that was [President Donald] Trump’s election,” Wilson told The Center Square. “I certainly see the parallels, and I’m very inspired by Mamdani’s race in New York City.”

Minneapolis’s Omar Fateh

Omar Fateh, a progressive candidate challenging incumbent Democrat Mayor Jacob Frey, has described himself as a democratic socialist in the past and supports a raft of policies similar to Mamdani and Wilson for his city. Minneapolis elections are officially nonpartisan, but Fateh is a member of the Democratic Party.

His tax policy calls for increasing taxes on the rich through a “local option tax” separate from state rates and a vacancy tax for commercial properties.

“I would say if someone makes a million dollars or above, they would be considered wealthy,” Fateh said in an interview with WCCO CBS News. “We want to come up with a way [for] the wealthy pay their fair share.”

To do this, Fateh, a member of the Minnesota State Senate, says he would propose the legislature approve a “local option tax” for Minneapolis, allowing the city to raise rates on its wealthiest residents to pay for the mayor’s policy programs. But, because Minneapolis has only a moderate level of income inequality, Fateh’s tax hikes could end up making middle income Minneapolitans pay more in taxes, Nathan Goldman, a tax professor at North Carolina State University wrote in Forbes.

Additionally, Goldman said another “a key concern” with a local option tax is that “the high-income taxpayers have a unique ability to relocate to avoid paying taxes.”

Fateh is also considering a commercial vacancy tax, which would impose new rates on landowners who are currently not making use of their properties. The policy is aimed at addressing “vacant storefronts” in the city, per Fateh’s campaign website.